June 15, 2016 - daveramsey.com

Millennials and Retirement

Study Summary

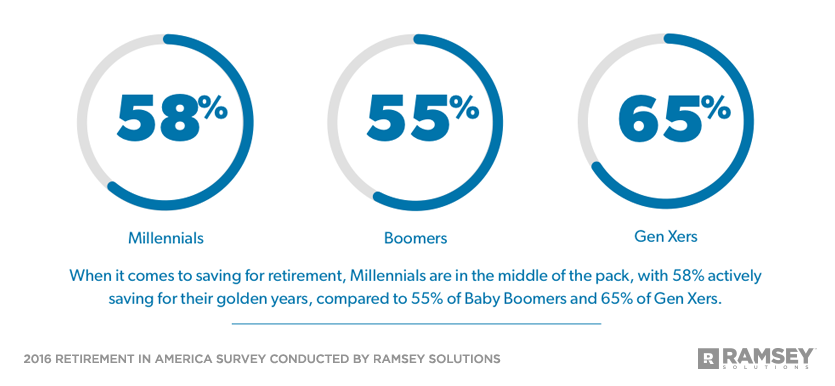

- 58% of Millennials are currently saving for retirement.

- Millennials are as likely to know how much money theyfll need to retire as baby boomers or Gen Xers.

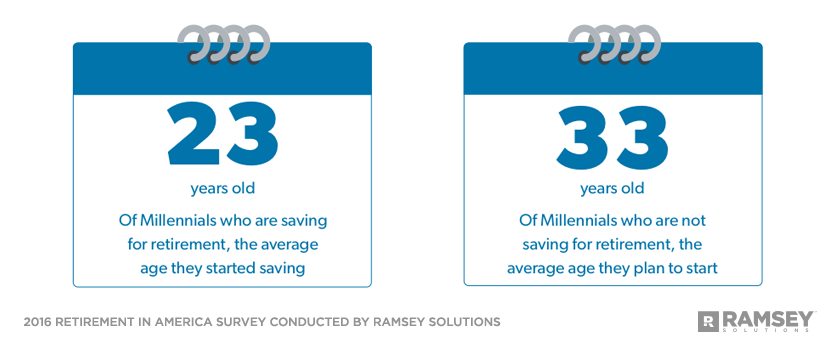

- Millennials begin saving for retirement at an average age of 23.

Millennials Outperforming Older Generations in Retirement Readiness

Eighteen years ago, as the first Millennials began to trickle into the workforce, older generations chose to view their advanced knowledge of technology and tendency to challenge the status quo negatively, labeling the group as nothing more than smartphone-addicted whiners with no work ethic.

Now, nearly two decades later, those older generations may be surprised to learn that Millennials are doing as well as, and in some ways better than, they are—at least when it comes to retirement.

Millennialsf Ability to Answer Big Retirement Questions On Par With Boomers and Gen Xers

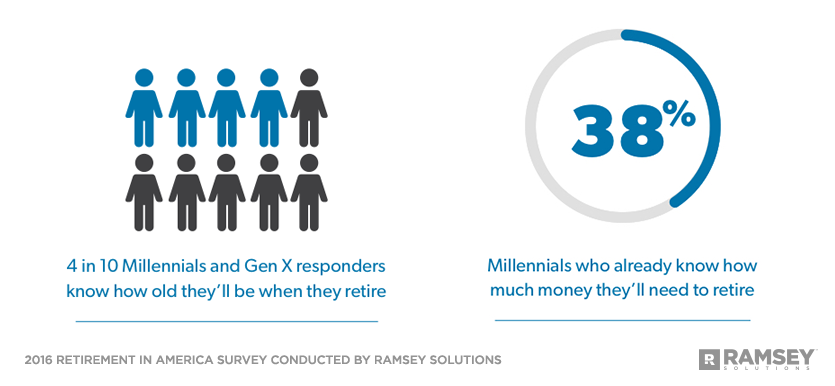

Ramsey Solutions commissioned a 2016 survey of more than 1,000 U.S. adults to evaluate the state of retirement in America. In the first of a four-part series based on results from the survey, 38% of Millennials reported they already know how much money theyfll need to retire—essentially the same as Baby Boomers, 37%, and Generation X, 36%.

And while Baby Boomers, many of whom are already retired, are more likely to be able to pinpoint their retirement age, Millennials and Gen Xers are on the same page, with four in 10 saying they know how old theyfll be when they retire.

Savings Habits Position Millennials for a Brighter Retirement Outlook

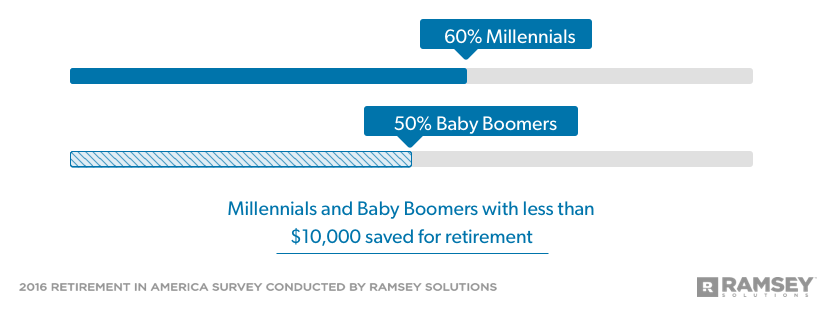

Even though Millennials have had less than 20 years to build their retirement wealth, they are not that far behind many of those who are closest to retirement. Nearly 60% of Millennials have less than $10,000 saved for retirement, but roughly half of Baby Boomers are in the same boat, despite the fact that this generation has had as much as half a century to save for their retirement.

gThese numbers confirm what we already know—a lot of Baby Boomers are going to have a tough time in retirement,h Chris Hogan, financial expert and number-one, national best-selling author of Retire Inspired, said.

gOn the other hand, the research also shows that Millennials are setting themselves up to have a much more positive retirement outlook,h Hogan added. gTheyfre already establishing savings habits that could keep them from following in the footsteps of older generations.h

Time: The Millennialsf Biggest Advantage

By focusing on retirement now, Millennials can take advantage of their most powerful retirement- building ally—time.

Of the 58% of Millennials who are actively saving for retirement, they began saving at an average age of 23. Another third say theyfll begin saving for retirement at an average age of 33. Since Millennials expect to retire between the ages of 60 and 65, that leaves at least three decades of wealth-building ahead of them.

gA 25-year-old who has managed to save $10,000 already could build a $200,000 retirement by the time she is 65 without saving another dime thanks to the power of compounding growth,h Hogan said.* gBut, a $200,000 retirement would be pretty skimpy even by todayfs standards, and it will have far less spending power in 2056.h

Of all the generations currently in the workforce, Millennials have the best chance of achieving a secure retirement.

That means an early start is just the beginning. Millennials will have to commit to saving more and stick to that commitment throughout their careers, a fact many of them are beginning to come to terms with. Seven in 10 say they wish they were already investing more, while nearly eight in 10 say they plan to save more in the future.

Millennials Face Same Old Savings Challenges

Whatfs keeping Millennials from saving as much as they want to for retirement today? Two words: life and debt.

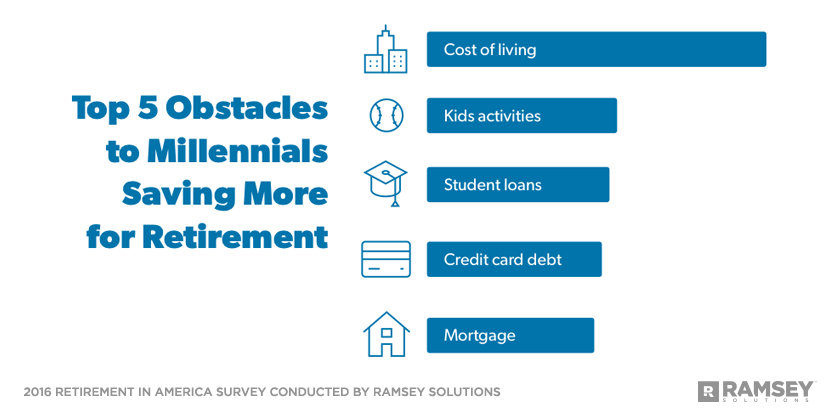

According to Millennials, the cost of living and the cost of meeting their childrenfs financial needs are their biggest obstacles to saving more for retirement. Student loans, credit card debt and mortgage debt round out the top five.

gWith the exception of student loans, these are the same expenses that have kept Baby Boomers and Gen Xers from saving as much as they need to for retirement,h Hogan pointed out. gMillennials like to shake things up, and if they want to shake up the retirement landscape in America, theyfll need to lead a much different lifestyle than the generations before them.h

To do that, Hogan says Millennials need to focus on eliminating their student loan and credit card debt, and, with the exception of a modest mortgage, commit to living debt-free. gAll that money youfre paying on your debts can make a huge difference in your retirement savings,h he said.

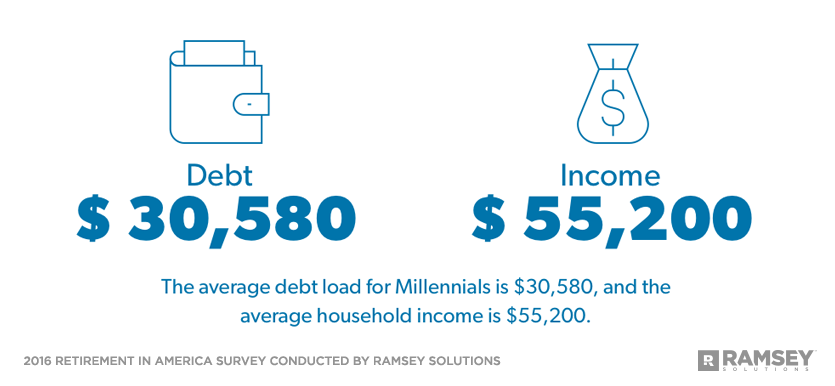

Of the Millennials who are actively saving, 39% set aside up to 9% of their income for retirement—$5,000 of the average annual Millennial household income of $55,200. Thirty years of investing at that rate would result in approximately $600,000 in retirement savings.** While that isnft a bad start, and it would put Millennials ahead of other generations, they will have to increase the amount they set aside to have a truly secure retirement.

The study found that the average Millennial debt load is $30,580. If Millennials focus on ridding themselves of the burden of monthly debt payments, they could boost their savings to the recommended 15% of their income and face retirement with more than $1 million.***

All that money youfre paying on your debts can make a huge difference in your retirement savings

Retirement Prospects Are on Their Shoulders

Another fact in Millennialsf favor is that they expect to be fully responsible for their own retirement security. Only 18% expect a pension to provide any portion of their retirement income, and just one in five are gvery confidenth that Social Security will be available when they retire.

While more than half of Baby Boomers expect Social Security to make up all or most of their retirement income, only 28% of Millennials hold the same belief. And although nearly two-thirds of all those surveyed expect Social Security to be their top source of retirement income (64%), Millennials rank Social Security a distant third (44%), choosing instead to rely on their own savings through a 401(k) (58%) and personal savings/cash (54%).

Conclusion: The Future Is Bright for Millennials—If They Remain Focused

As a group, Millennials feel as though theyfll be able to reach their retirement goals. More than three-quarters say they are gsomewhath or gvery confidenth theyfll have enough money for retirement. Only 64% of respondents overall feel the same way.

gItfs encouraging to see many Millennials saving for retirement,h Hogan said. gBut there are still many who need to take steps toward saving.h

gMillennials have a great chance of achieving a secure retirement, but they have to take advantage of that momentum, get rid of their debt and increase the amount theyfre putting toward retirement now. By doing these things they can have the kind of future theyfve always dreamed of living.h

About Ramsey Solutions

Ramsey Solutions is committed to helping people take control of their money, build wealth, grow their leadership skills and enhance their lives through personal development. The companyfs success is defined by the number of people whose lives are changed by a message of hope. Through a variety of mediums, including live events, a corporate financial wellness program, publishing, syndicated columns, and two nationally syndicated radio shows, Ramsey Solutions uses commonsense education to empower people to win at life and money. Millions of families have graduated from Financial Peace University classes across the country, and Ramsey Solutionsf world-class speakers have brought vision, inspiration, and encouragement to more than a million more. Voted among Nashvillefs best places to work nine times, Ramsey Solutions employs more than 500 team members focused and dedicated to doing work that matters.

About Chris Hogan

A popular and dynamic speaker on the topics of personal finance, retirement and leadership, Chris Hogan helps people across the country develop successful strategies to manage their money in both their personal lives and businesses. His new book Retire Inspired: Itfs Not an Age. Itfs a Financial Number released in January 2016 and is a number- one national best seller. For more than a decade, Chris has served at Ramsey Solutions as a trusted financial coach and Ramsey Personality. You can follow Chris on Twitter at @ChrisHogan360 and online at chrishogan360.com.

Notes

Retirement in America is a research study conducted with 1,016 U.S. adults to gain an understanding on attitudes, behaviors and perceptions around the topics of retirement. The nationally representative sample was polled between February 26 and March 1 using a third-party research panel.

For the purposes of this study, the different generations are defined as follows:

- Baby Boomers: born 1946–1964 Gen Xers: born 1965–1979 Millennials: born 1980–1997

- *$10,000 at an 8% return over 40 years=$242,743

- **4% of $55,200=$184/month

- $184 per month invested at an 8% return for 30 years=$274,225

- ***15% of $55,200=$690/month

- $690 per month invested at an 8% return for 30 years=$1,028,347